Our Nvidia Thesis Revealed, Pro Stock Market Analysis

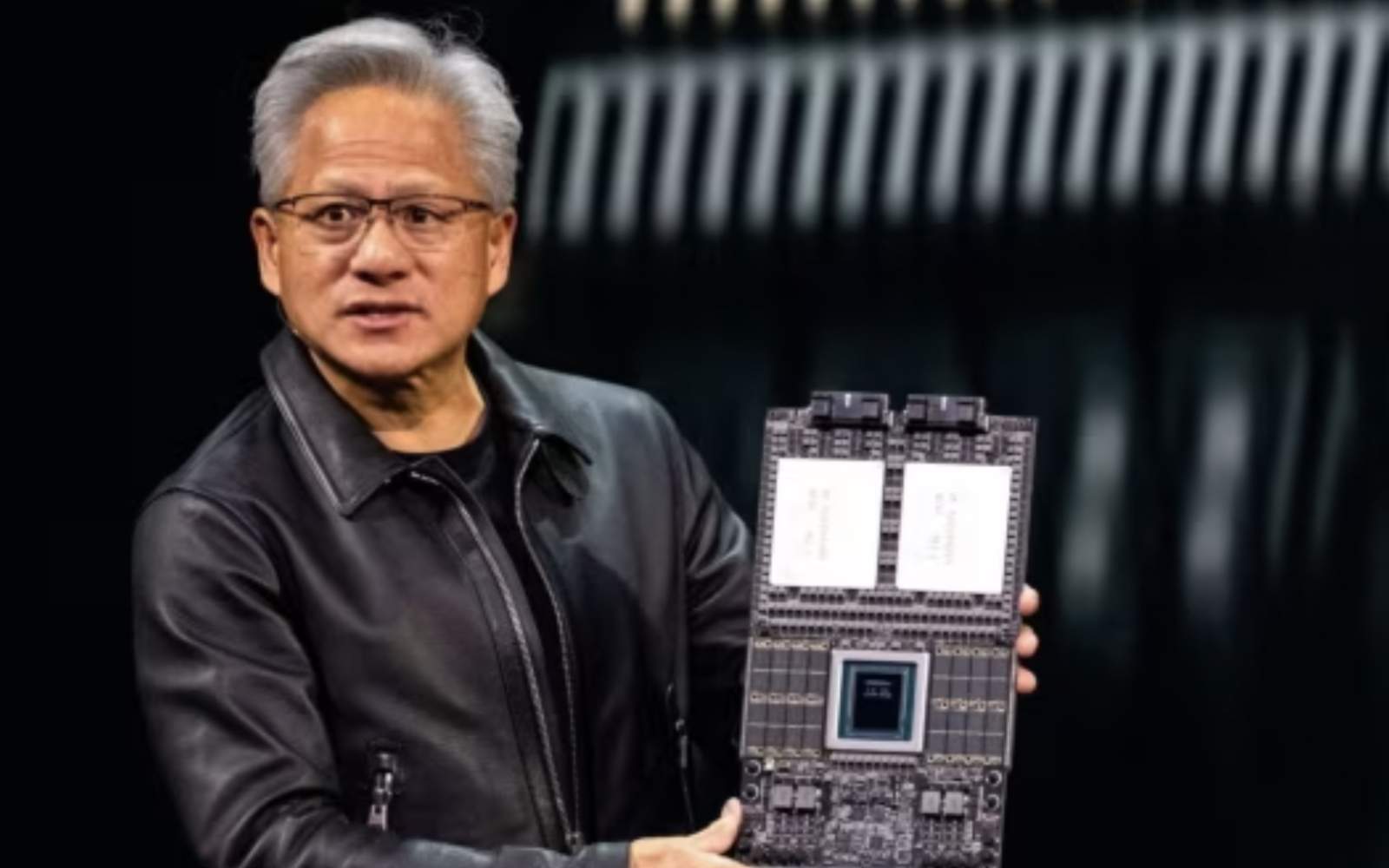

In the world of investing, stability is often seen as the ultimate virtue. But what if a company’s greatest strength lies in its deliberate embrace of chaos? For a titan like Nvidia, the constant state of upheaval—record growth paired with massive spending, market dominance met with geopolitical crises—isn't a sign of weakness; it's a calculated strategy. This approach creates a complex puzzle for investors and makes a traditional stock valuation an incredibly challenging exercise, as our visual breakdown reveals. Understanding this strategy of "calculated turmoil" is the key to decoding not just Nvidia, but a new breed of ambitious, world-shaping companies.

The Stock Valuation Paradox of a Chaos Agent

The most glaring symptom of Nvidia's strategy is the "Growth vs. Valuation Paradox" that leaves many analysts perplexed. How can a company smashing revenue records by over 50% see its stock valuation multiples fluctuate so dramatically? The answer is that the market prizes certainty, and Nvidia is actively trading short-term certainty for long-term dominance. This intentional chaos is a feature, not a bug.

When a company makes massive, multi-billion-dollar bets on the future, it introduces a level of uncertainty that traditional stock valuation models struggle to price. The result is a tug-of-war in its stock price: one day, the market celebrates the growth; the next, it recoils from the risk. This volatility isn't a sign of a flawed business but rather the price of admission for a company aggressively building the next technological kingdom.

Funding the Chaos: The Balance Sheet as an Offensive Weapon

A strategy of calculated turmoil would be suicidal for most companies. The massive "cash burn" from heavy investment and the shock of losing a major market would trigger a liquidity crisis. But this is where Nvidia's story diverges, and where a deeper stock valuation analysis becomes critical. Nvidia's "unsinkable balance sheet" is not just a defensive safety net; it's an offensive weapon.

With an exceptionally strong financial core, exemplified by a near-unprecedented Altman Z-Score, Nvidia has what few others do: the permission to be bold. It can afford to pour billions into R&D and acquisitions, knowing its core operations remain a healthy, cash-generating machine. This financial fortress is the engine that funds the chaos, allowing the company to make moves that would bankrupt lesser-equipped rivals. A proper stock valuation must therefore include a premium for this strategic freedom.

Geopolitical Judo: Weaponizing an External Crisis

Nowhere is the strategy of calculated turmoil more evident than in Nvidia’s handling of the "China Black Hole." On the surface, losing 95% of a key market due to US export controls is a catastrophic blow. For a lesser company, it would be. But for a grand strategist, an external crisis can be the perfect catalyst for a difficult but necessary pivot.

Instead of being a victim, Nvidia performed a kind of "geopolitical judo," using the momentum of the crisis to accelerate its de-risking from a volatile market and pivot toward fortifying a subsidized American chip ecosystem. It turned a seemingly devastating event into an opportunity to strengthen its long-term strategic position. This ability to absorb a massive shock and turn it into a strength has profound implications for the company's long-term stock valuation, suggesting a level of resilience that is hard to quantify.

A New Framework for Stock Valuation in an Age of Ambition

So, how does one approach the stock valuation of a company that thrives on chaos? It requires moving beyond static, rear-view mirror metrics. A simple P/E ratio fails to capture the value of a company’s ambition or the strategic optionality granted by a fortress-like balance sheet. A more modern approach to stock valuation must be qualitative as well as quantitative.

This new framework involves asking different questions. What is the value of a CEO who operates as a grand strategist? How much is a nearly unbreachable software moat worth? What premium should be assigned to a balance sheet that allows a company to not just weather storms, but create them for its competitors? The focus shifts from valuing what the company *is* today to valuing what it has the power and resources to *become* tomorrow.

Summary: Decoding Chaos for a Clearer Thesis

Nvidia's strategy of calculated turmoil is a masterclass in modern corporate strategy. By leveraging its immense financial strength, it willingly introduces short-term uncertainty to build an unassailable long-term position. This makes a simple stock valuation challenging, but it also reveals the limitations of conventional analysis when faced with a truly transformational company.

Understanding this approach is crucial for any serious investor. Reading about it is one thing, but seeing the jaw-dropping financial data and strategic moves laid out visually is what brings it all to life. To see the numbers that make this chaos possible and to get a clearer picture of this complex stock valuation puzzle, watch our complete video analysis. It will change the way you look at a company's ambition and risk.

![]() Do you find this article helpful and valuable? Did you learn useful and interesting information that matters to you? Help others discover this valuable knowledge by leaving a comment below and sharing it with your friends and network.

Do you find this article helpful and valuable? Did you learn useful and interesting information that matters to you? Help others discover this valuable knowledge by leaving a comment below and sharing it with your friends and network.

Comments