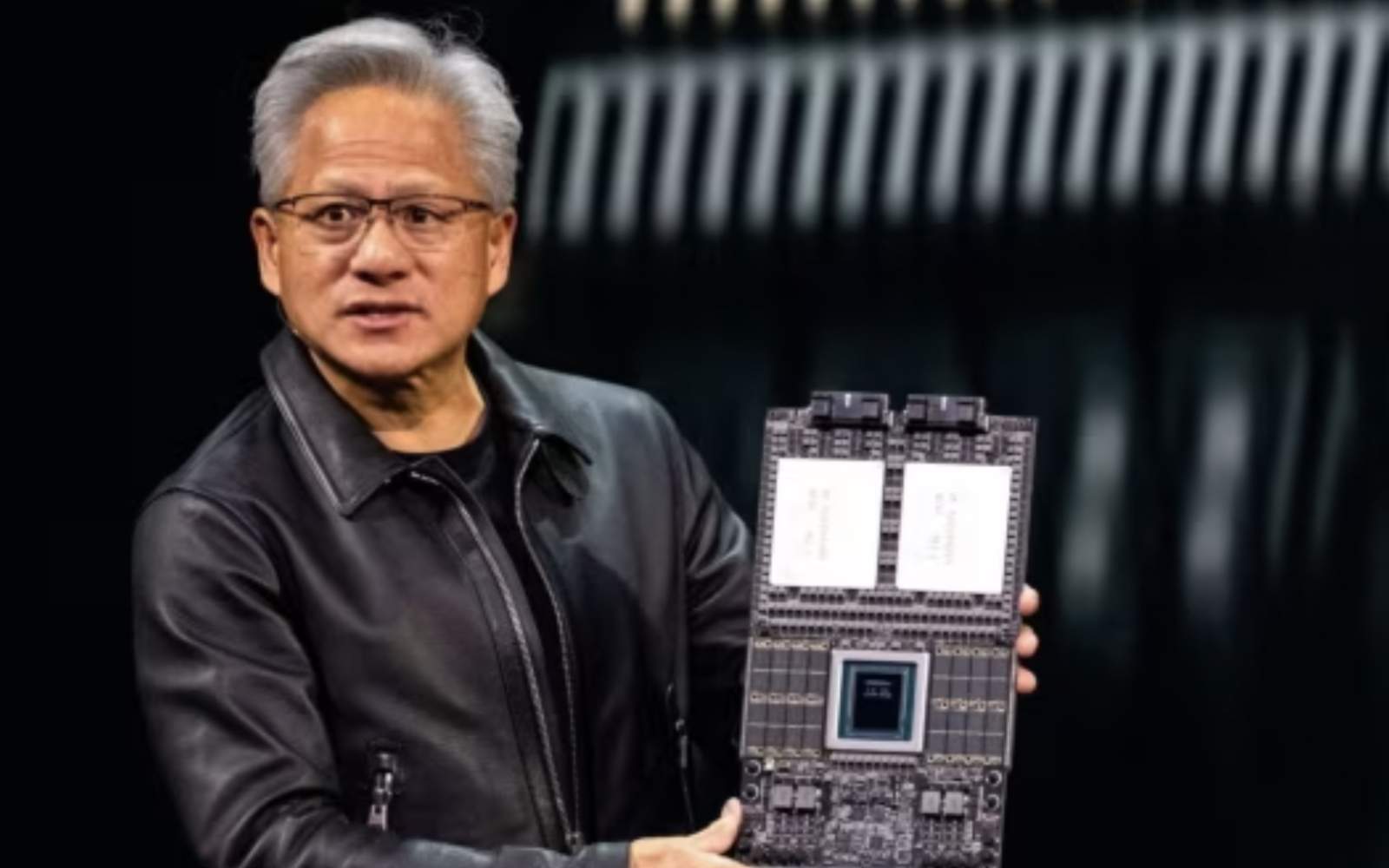

Are AMD, Intel, and Big Tech a Real Threat?

Nvidia’s journey to the summit of the tech world has been nothing short of spectacular, cementing its position as the undisputed king of the AI hardware revolution. The company's name has become synonymous with the powerful GPUs that form the backbone of modern machine learning. However, no monarch reigns forever without facing challengers, and the battle for the future of AI compute is far from over. While a detailed look at Nvidia's financial fortitude and valuation reveals a company with the resources to wage a long war, it is the nature of its rivals' strategies that will define the coming era.

The Fortress on the Hill: Nvidia’s Defensible Kingdom

To understand the challenge facing Nvidia’s competitors, one must first appreciate the scale of the fortress they are trying to breach. Nvidia's dominance is not merely a result of having the fastest chip on the market at any given moment. Its true power lies in the deep, entrenched software ecosystem known as CUDA, a proprietary platform that has become the de facto industry standard for AI development over the past two decades.

This creates a powerful "flywheel effect." Millions of developers are trained on CUDA, thousands of applications are built with it, and a vast library of research and optimization is based on it. For a company to switch from Nvidia, it must not only find comparable hardware but also bear the immense cost and effort of rewriting its software, retraining its teams, and abandoning a mature, stable ecosystem. This immense switching cost is Nvidia's most formidable defense.

The Direct Assault: AMD's Hardware and Open-Source Gambit

Nvidia's most direct challenger is its long-time rival, AMD. After years of focusing on other markets, AMD has re-entered the data center AI space with significant force, led by its Instinct series of accelerators, like the MI300X. On paper, AMD's hardware offers competitive, and in some cases superior, performance metrics, posing a legitimate threat to Nvidia's top-tier chips.

However, AMD understands that hardware alone is not enough. Its key strategic weapon against CUDA is ROCm, its open-source software platform. By offering an open alternative, AMD is appealing to customers wary of Nvidia's proprietary lock-in and high prices. The gambit is that the promise of flexibility, transparency, and a community-driven approach will be enough to slowly chip away at CUDA's dominance, even if ROCm currently lacks the same level of maturity and broad support.

The Industrial Giant: Intel’s Long Game

While Intel has been slower to pivot to the AI accelerator market, it remains an industrial behemoth with deep pockets and world-class manufacturing ambitions. Its Gaudi line of AI accelerators represents a credible, albeit less established, alternative for specific training and inference workloads. Intel's strategy is less about a head-on assault and more about a long-term play, leveraging its unique position as an integrated device manufacturer.

Intel's path is intertwined with geopolitics, especially with the push from the U.S. government to build a resilient domestic supply chain. This creates a complex dynamic where Intel is both a competitor to Nvidia and a crucial national partner. Nvidia's investment in Intel, as noted in the source analysis, highlights this "co-opetition," where shoring up the American semiconductor ecosystem is a shared goal, even among rivals.

The Internal Threat: Hyperscalers Forging Their Own Tools

Perhaps the most significant long-term threat to Nvidia's reign comes not from traditional competitors, but from its own biggest customers. "Hyperscalers" like Google (with its TPUs), Amazon (with Trainium and Inferentia), and Microsoft (with Maia) are investing billions to design their own custom AI silicon. Their motivation is simple: cost and optimization.

When a single company consumes hundreds of thousands of GPUs, the economic incentive to develop a custom chip tailored perfectly to its specific workloads becomes enormous. These in-house chips are not meant to be sold on the open market but are designed to reduce dependence on Nvidia and lower the astronomical costs of running massive AI data centers. This trend represents a potential slow erosion of Nvidia's core customer base, a "death by a thousand cuts" scenario that could temper its phenomenal growth.

Conclusion: The Throne is Secure, But The War Has Begun

Nvidia's position at the top of the AI hierarchy is secure for the immediate future, protected by the formidable moat of its CUDA ecosystem. However, the landscape is shifting rapidly. The company faces a multi-front war: a direct hardware and software challenge from AMD, a long-term industrial play from Intel, and a quiet insurrection from its largest customers who are forging their own paths.

The ultimate test for Nvidia will be whether its platform's value can continue to outweigh the allure of open-source alternatives and the cost savings of custom silicon. Fighting this multi-front war requires not just technological superiority but immense financial power and strategic ambition. The company's ability to make bold, aggressive moves is a direct result of its underlying financial health.

To truly understand the foundation that allows Nvidia to confidently face these gathering threats, one must look beyond the competitive landscape and into its core financials. Explore the detailed analysis of Nvidia's balance sheet and valuation to see the "unsinkable" financial fortress that funds its reign.

![]() Do you find this article helpful and valuable? Did you learn useful and interesting information that matters to you? Help others discover this valuable knowledge by leaving a comment below and sharing it with your friends and network.

Do you find this article helpful and valuable? Did you learn useful and interesting information that matters to you? Help others discover this valuable knowledge by leaving a comment below and sharing it with your friends and network.

Comments