The CEO X-Factor Analysis, Nvidia's Intrinsic Value

When attempting to calculate a company's intrinsic value, analysts often get lost in a sea of spreadsheets, projecting cash flows and debating discount rates. But what if one of the most significant assets can't be found on any balance sheet? For a company like Nvidia, the "X-factor" of its visionary leadership may be the most critical component of its success, yet it's the hardest to quantify. To see a visual breakdown of how this strategic leadership directly shapes the very financial metrics that confuse the market, watch our complete analysis intrinsic value. This is where the art of investing meets the science of financial analysis, a core theme we explore on our channel.

The Limits of Traditional Intrinsic Value Calculation

The classic approach to finding a stock's intrinsic value, such as a Discounted Cash Flow (DCF) analysis, is a powerful tool. It forces you to think critically about a company's future earnings potential. However, its greatest strength is also its biggest weakness: it relies on a set of assumptions about the future that are based on a company's current trajectory.

But what happens when a company is led by a "grand strategist"—a CEO who doesn't just manage the present but actively architects a different future? A leader like this can make a DCF model obsolete overnight by entering a new market, creating a new technology, or executing a strategic pivot that was previously unthinkable. In these cases, the calculated intrinsic value becomes a moving target, constantly reshaped by the force of a singular vision.

The CEO as a Strategic Asset: The 'Jensen Premium'

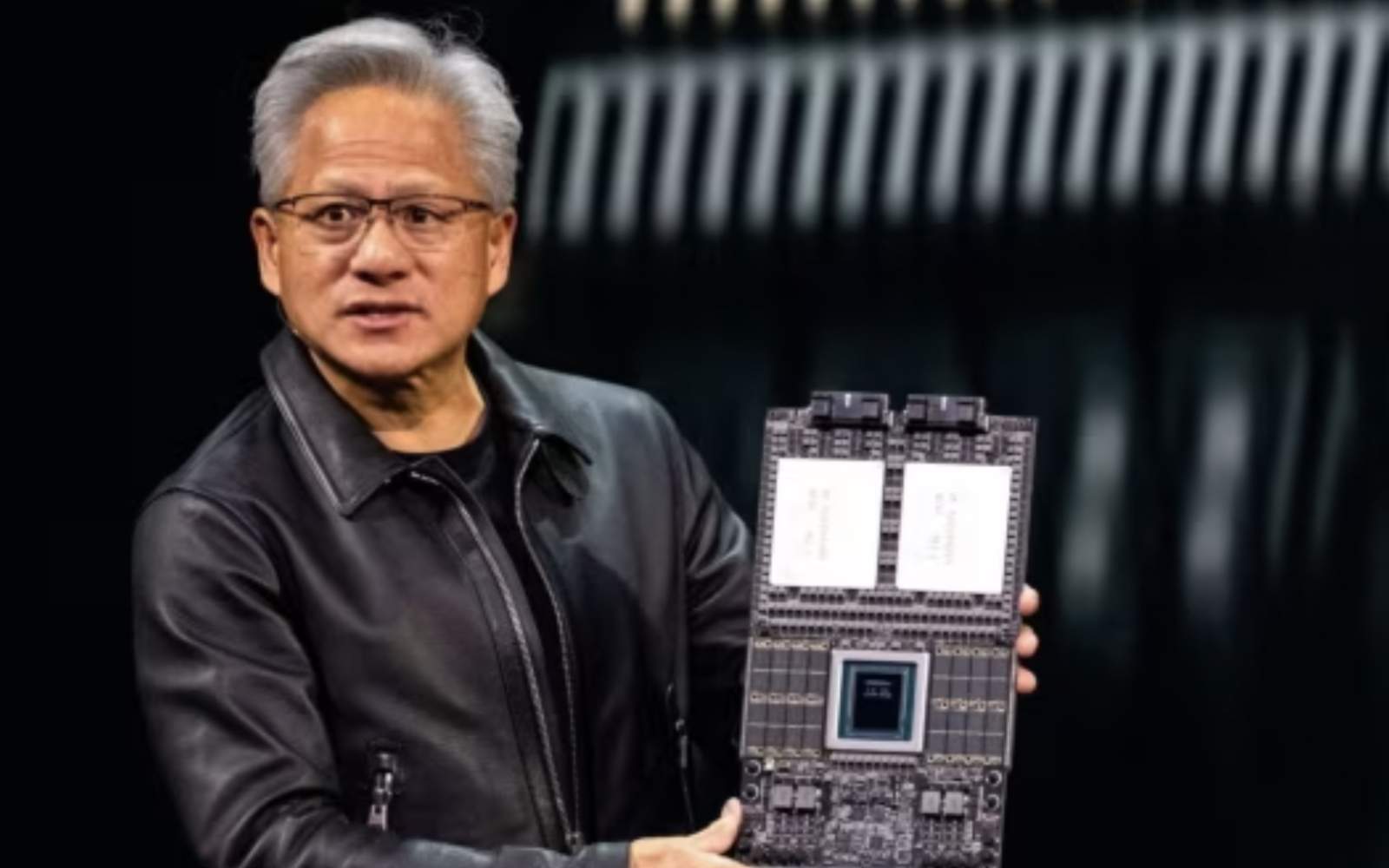

Nvidia's CEO, Jensen Huang, is a prime example of this phenomenon. His leadership is an intangible asset that a spreadsheet cannot capture. When faced with the "China Black Hole"—the sudden evaporation of a key market—a conventional CEO might have focused on damage control and appeasement. Huang, however, used the crisis as a catalyst for a bold strategic realignment.

This is the kind of leadership that creates long-term value beyond what financial models can predict. The ability to navigate a geopolitical minefield and emerge with a more resilient, de-risked strategy adds a qualitative premium to the company's intrinsic value. Investors who can recognize and appreciate this "Jensen Premium" have a distinct advantage over those who only see the negative headline. On our channel, we specialize in identifying these hard-to-quantify leadership traits and connecting them to financial performance.

Giving Context to the Numbers: Ambition vs. Recklessness

Leadership also provides the essential context for interpreting financial data. Take Nvidia's "Great Cash Burn," a data point that sends shivers down the spines of many investors. Without context, a multi-billion-dollar negative cash flow screams "liquidity crisis." But with the context of a visionary leader at the helm, the narrative transforms.

This spending is not a sign of operational failure; it is the down payment on an AI kingdom. It's the cost of trying to own the entire technological stack for the next generation of computing. A leader's vision is what separates a reckless gamble from a calculated, world-changing investment. As we show visually in our video analysis, seeing the cash flow statement broken down this way makes it clear that the company is funding ambition, not failure, fundamentally increasing its long-term intrinsic value.

The Balance Sheet: The Foundation for Visionary Action

Of course, a visionary CEO with a weak balance sheet is just a dreamer. A visionary CEO with a fortress-like balance sheet is a force of nature. This is the final piece of the puzzle and the ultimate validator of the leadership premium. Nvidia’s "unsinkable balance sheet" is what gives its leadership the freedom to be bold.

An exceptionally strong financial position, as measured by metrics like the Altman Z-Score, means the company can afford to make huge bets, absorb massive shocks, and play the long game. This financial strength and visionary leadership create a powerful symbiotic relationship. The vision directs the company's immense resources, and the resources empower the vision. A comprehensive analysis of intrinsic value must account for this powerful flywheel effect.

Summary: The Art and Science of Assessing Intrinsic Value

Ultimately, the true intrinsic value of a company like Nvidia is a composite of its quantifiable financial strength and the unquantifiable X-factor of its leadership. Relying on one without the other gives you an incomplete and often misleading picture. By learning to analyze not just the numbers, but the strategic mind directing them, you can develop a more sophisticated and resilient investment thesis.

This is the approach we take in every video on our channel. We believe that the best investment insights come from blending rigorous data analysis with a deep understanding of strategy and leadership. To see how these elements converge in the fascinating case of Nvidia and to understand the real story behind its numbers, watch our full video analysis. You'll get the visual proof you need to see why its intrinsic value is far more than the sum of its financial parts.

![]() Do you find this article helpful and valuable? Did you learn useful and interesting information that matters to you? Help others discover this valuable knowledge by leaving a comment below and sharing it with your friends and network.

Do you find this article helpful and valuable? Did you learn useful and interesting information that matters to you? Help others discover this valuable knowledge by leaving a comment below and sharing it with your friends and network.

Comments